| Year1 |

TSP Coach |

| 2005 |

2.66% |

| 2006 |

2.46% |

| 2007 |

2.82% |

| 2008 |

4.10% |

| 2009 |

1.85% |

| 2010 |

6.00% |

| 2011 |

5.89% |

| 2012 |

1.89% |

| 2013 |

2.71% |

| 2014 |

2.50% |

| 2015 |

3.69% |

| 2016 |

2.91% |

| 2017 |

0.90% |

| 2018 |

4.38% |

| 2019 |

3.76% |

| 2020 |

8.01% |

| 2021 |

3.02% |

| 2022 |

6.07% |

| 2023 |

4.62% |

| 2024 |

1.51% |

| As of: |

06/13/2025 |

| L Income |

L 2025 |

L 2030 |

L 2035 |

L 2040 |

L 2045 |

L 2050 |

L 2055 |

L 2060 |

L 2065 |

G Fund |

F Fund |

C Fund |

S Fund |

I Fund |

| |

|

|

|

|

|

|

|

|

|

0.04% |

0.84% |

2.16% |

3.32% |

2.77% |

| 0.37% |

|

1.48% |

|

1.70% |

|

|

|

|

|

0.04% |

0.73% |

1.56% |

3.06% |

2.60% |

| 0.49% |

|

1.90% |

|

2.16% |

|

|

|

|

|

0.05% |

0.73% |

2.68% |

3.00% |

2.77% |

| 1.29% |

|

4.72% |

|

5.40% |

|

|

|

|

|

0.05% |

1.69% |

5.82% |

7.61% |

7.47% |

| 1.36% |

|

4.78% |

|

5.45% |

|

|

|

|

|

0.03% |

0.92% |

6.16% |

7.12% |

7.65% |

| 1.07% |

|

3.91% |

|

4.49% |

|

|

|

|

|

0.04% |

0.80% |

5.32% |

6.07% |

6.56% |

| 0.95% |

|

3.38% |

|

3.89% |

|

|

|

|

|

0.04% |

0.64% |

4.41% |

6.00% |

5.43% |

| 0.65% |

|

2.30% |

|

2.64% |

|

|

|

|

|

0.01% |

0.56% |

2.91% |

3.44% |

4.59% |

| 0.51% |

|

1.68% |

|

1.94% |

|

|

|

|

|

0.03% |

0.88% |

2.35% |

2.89% |

3.29% |

| 0.49% |

|

1.61% |

|

1.87% |

|

|

|

|

|

0.01% |

0.63% |

2.28% |

3.48% |

2.71% |

| 0.71% |

|

2.36% |

|

2.72% |

|

|

|

|

|

0.02% |

0.82% |

3.78% |

3.58% |

4.11% |

| 0.59% |

|

1.96% |

|

2.29% |

|

|

|

|

|

0.02% |

1.03% |

2.84% |

4.47% |

3.47% |

| 0.16% |

|

0.50% |

|

0.59% |

|

|

|

|

|

0.01% |

0.43% |

1.09% |

1.42% |

1.17% |

| 0.77% |

|

2.34% |

|

2.79% |

|

|

|

|

|

0.02% |

0.86% |

4.24% |

4.92% |

3.45% |

| 0.69% |

|

2.06% |

|

2.47% |

|

|

|

|

|

0.03% |

0.95% |

3.56% |

4.68% |

3.16% |

| 1.63% |

|

4.54% |

|

5.43% |

|

|

|

|

|

0.03% |

0.95% |

7.18% |

10.19% |

7.30% |

| 0.62% |

1.21% |

1.61% |

1.76% |

1.91% |

2.05% |

2.18% |

2.63% |

2.63% |

2.63% |

0.02% |

0.79% |

3.05% |

3.29% |

2.76% |

| 1.59% |

2.62% |

3.79% |

4.16% |

4.52% |

4.83% |

5.13% |

6.05% |

6.05% |

6.06% |

0.07% |

2.34% |

6.21% |

6.87% |

6.42% |

| 1.21% |

1.72% |

2.76% |

3.04% |

3.31% |

3.54% |

3.76% |

4.39% |

4.39% |

4.39% |

0.04% |

2.35% |

4.07% |

6.44% |

4.60% |

| 0.36% |

0.45% |

0.75% |

0.82% |

0.88% |

0.94% |

1.00% |

1.23% |

1.23% |

1.23% |

0.13% |

0.39% |

1.51% |

1.85% |

0.77% |

| 1Life starting dates for TSP funds are August 31, 2004. TSP Coach strategy has been in use since August 2004. |

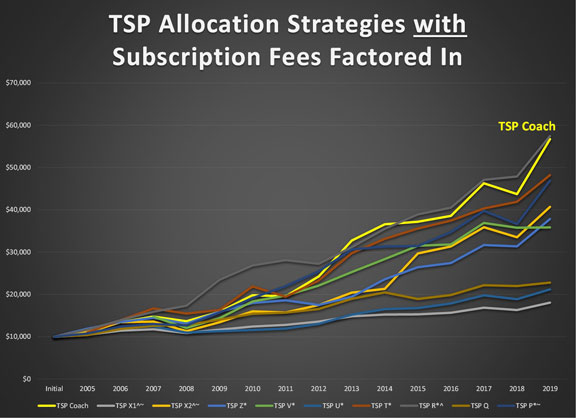

This table shows the risk based on monthly returns for each of the TSP Funds, Lifecycle Funds and TSP Coach. My TSP Fund

allocations have reduced my risk, but does not lower it to levels that inhibit my returns. While I utilize the Sharpe Ratio

in my calculations, and risk is an important part of this equation, I also perform proprietary calculations to ensure that

the often times conservative nature of the Sharpe Ratio does not limit the performance of my Thrift Savings Plan investments.